Articles

Learn more about how to start a business / company in Malaysia and how to operate it properly under the laws of Malaysia. If you're starting up new, the articles are very useful for new business owners too.

Boss, Ask Me Lah!

Got a question about Sdn Bhd ?or about Company Secretary ? or...

Customer Testimonials

Hear what our valuable clients have to say about their experience with Bossboleh.

Boss Boleh’s Budget Newsletter 2022 Edition

Budget 2022 was announced on 29th October 2021 as the nation emerges from the pandemic. This budget 2022 proposals are to reconstruct the economy were created around the primary themes of recovery, resilience, and reform. Measures aimed at raising government tax revenues and spurring investment are included in tax plans.

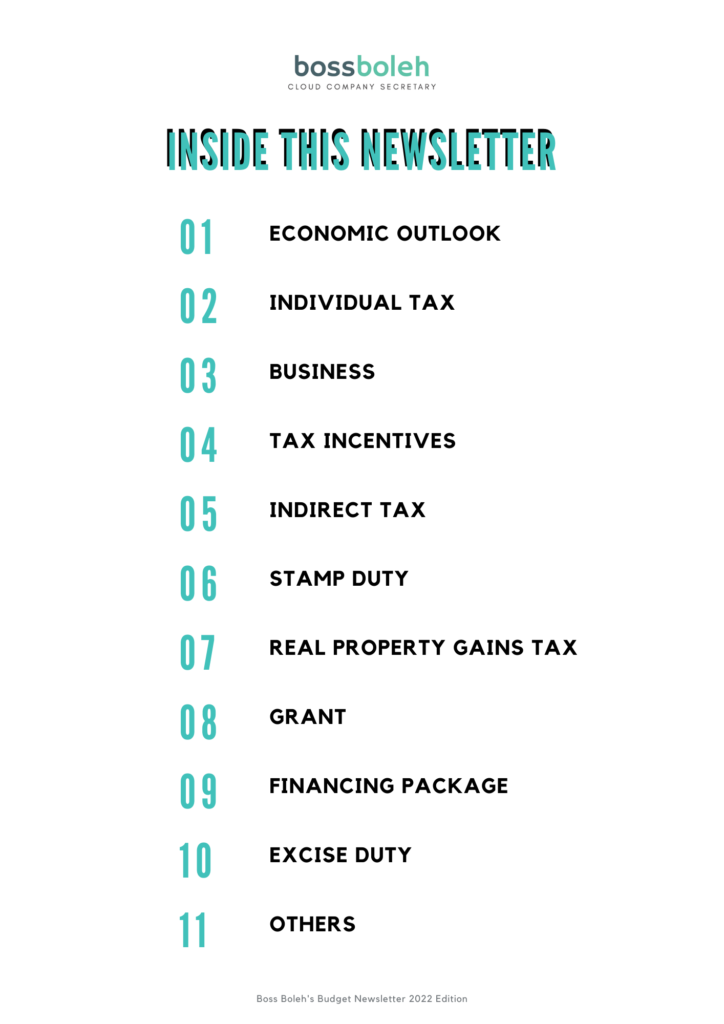

INSIDE THE NEWSLETTER

01 Economic Outlook

02 Individual Tax

03 Business

04 Tax Incentives

05 Indirect Tax

06 Stamp Duty

07 Real Property Gains Tax

08 Grant

09 Financing Package

10 Excise Duty

11 Others

Budget 2022 is a budget from the people, by the people, and for the people, as mentioned by Prime Minister Datuk Seri Ismail Sabri Yaakob. This budget includes a wide range of deductions and incentives for businesses, employment, women’s development, cost of living, rural development, and other areas that will help sustain and spur economic activity, rebuild economic resilience, and catalyze the reform agenda in the face of the Covid-19 pandemic’s backdraft.

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

Are you ready to form your Sdn Bhd with Malaysia’s #1 award-winning Online Company Secretary? Contact us now via WhatsApp @018-767 8055