Articles

Learn how to start and properly operate a business in Malaysia. These articles are also useful for new business owners.

Customer Testimonials

Hear what our valuable clients have to say about their experience with Bossboleh.

BB e-Learning School

Education should be accessible to all. This platform breaks barriers with curated video lessons at your fingertips.

Secretary Fee & Tax Agent Fee

Tax Deduction for Secretarial and Tax Filing Fee

Pursuant to the Income Tax (Deduction For Expenses in Relation to Secretarial Fee and Tax Filing Fee) Rules 2020 [P.U.(A) 162/2020] published by the Federal Government on 19 May 2020, the following expenses incurred shall be allowed for tax deduction with effect from year of assessment 2020:

- Before YA 2020:

- Maximum secretary fee deductible amount: RM 5,000

- Maximum tax agent fee deductible amount: RM 10,000

- Starting from YA 2020:

- Maximum secretary fee + tax agent fee deductible amount: Combined RM 15,000

Requirements

- Secretarial Fee:

- charged for secretarial services provided by a company secretary registered under Companies Act 2016 (Act 777)

- which is incurred and paid by the person in the basis period for the year of assessment.

- Deductible Secretary Fee:

- Monthly/Yearly secretary fee

- Preparation of AGM

- Preparation for resolution

- Share allotment/transfer fee

Note: Services must be provided by Registered Secretary under Companies Act 2016

Tax Filing Fee

- Charged for the preparation and submission of return in the prescribed form as follows:

- Tax Filing Fee (charged by approved tax agent under Income Tax Act)

– for the purpose of sections 77, 77A, 77B, 83 (for the basis period of the immediately preceding year of assessment) and Section 107C of the Act - SST Filing Fee

– for the purpose of Sales Tax Act 2018 (Act 806) and Services Tax Act 2018 (Act 807) - Filing of Return for Departure Levy

– for the purpose of Section 19 of Departure Levy Act 2019 (Act 813) - Filing of Return for Tourism Tax

– for the purpose of Section 19 of Tourism Tax Act 2017 (Act 791)

- Tax Filing Fee (charged by approved tax agent under Income Tax Act)

- Deductible Tax Agent Fee:

- Tax computation/submission fee (Form C)

- Tax prepayment submission fee (CP204, CP204A & CP204B)

- SST submission fee

- Departure levy form submission fee

- Tourism tax submission fee

Note: Services must be provided by Licensed Tax Agent

- Any reimbursement for secretary and tax agent related fee are not deductible.

- All secretary and tax agent related fee must be paid and incurred for the past or existing year end.

- The total deduction allowed is up to maximum of RM15,000 for a year of assessment.

- These rules are effective from year of assessment 2020.

- Income Tax (Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee) Rules 2014 [P.U.(A) 336/2014 is revoked.

Read more about income tax here.

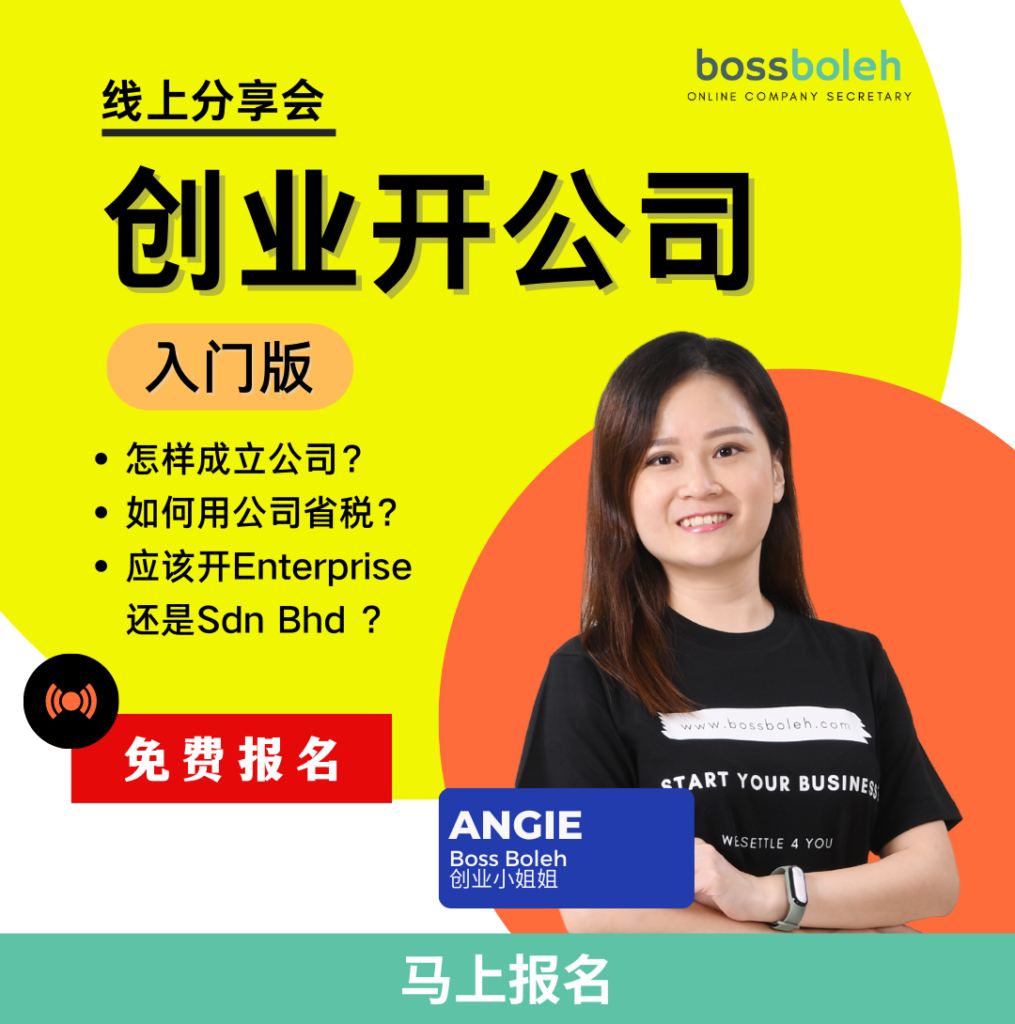

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

Are you ready to form your Sdn Bhd with Malaysia’s #1 award-winning Online Company Secretary? Contact us now via WhatsApp @ 018-7678055!