Articles

Learn how to start and properly operate a business in Malaysia. These articles are also useful for new business owners.

Customer Testimonials

Hear what our valuable clients have to say about their experience with Bossboleh.

BB e-Learning School

Education should be accessible to all. This platform breaks barriers with curated video lessons at your fingertips.

Understanding Company Tax Rates

Understanding Company Tax Rates

To start up a business in Malaysia, a better understanding of company income tax requirements by the Inland Revenue Board (LHDN) and the Royal Malaysian Customs Department (RMCD) will ease the struggles faced throughout the growth of your business.

Malaysia’s company tax is administered by the Income Tax Act 1967, whereby all companies registered in Malaysia for chargeable income derived from Malaysia complies with this Act.

Definition of SME for Tax Purpose

SME companies are defined with:

- Paid-up share capital not exceeding RM2.5 million

- Gross income (business source) not exceeding RM50 million

New Ruling on Foreign Shareholders (wef Year of Assessment 2024)

With effect from YA 2024, there is one more condition for SMEs to enjoy the preferential tax rate

If equal or more than 20% of paid-up share capital is owned by a foreign company or non-Malaysia citizen, the SME will not be entitled to the 15% and 17% preferential tax rate.

Tax Implication on Foreign Shareholding Equal or More Than 20%

Taxpayers will be subject to a 24% tax rate if a foreigner owns equal or more than 20% shareholding in the company.

Corporate Income Tax (as of YA 2024 and onwards)

According to the latest rate for Year Assessment 2024 and onwards, company tax rates are categorized as followed:

- Companies with paid-up capital of RM 2.5 million or less at the beginning of the basis period, and having gross business income from one or more sources from the relevant year of assessment of not more than RM50 million

- On the first RM 150,000 chargeable income – 15%

- RM 150,001 to RM 600,000 chargeable income – 17%

- RM 600,001 and above – 24%

- Companies with paid-up capital of RM 2.5 million and above at the beginning of the basis period – 24%

- Non-resident company/ branch – 24%

| Chargeable Income | Percentage (%) |

| First RM 150,000 | 15 |

| RM 150,001 to RM 600,000 | 17 |

| RM 600,001 and above | 24 |

To know more about the changes of Malaysian company tax rates throughout the years, click here.

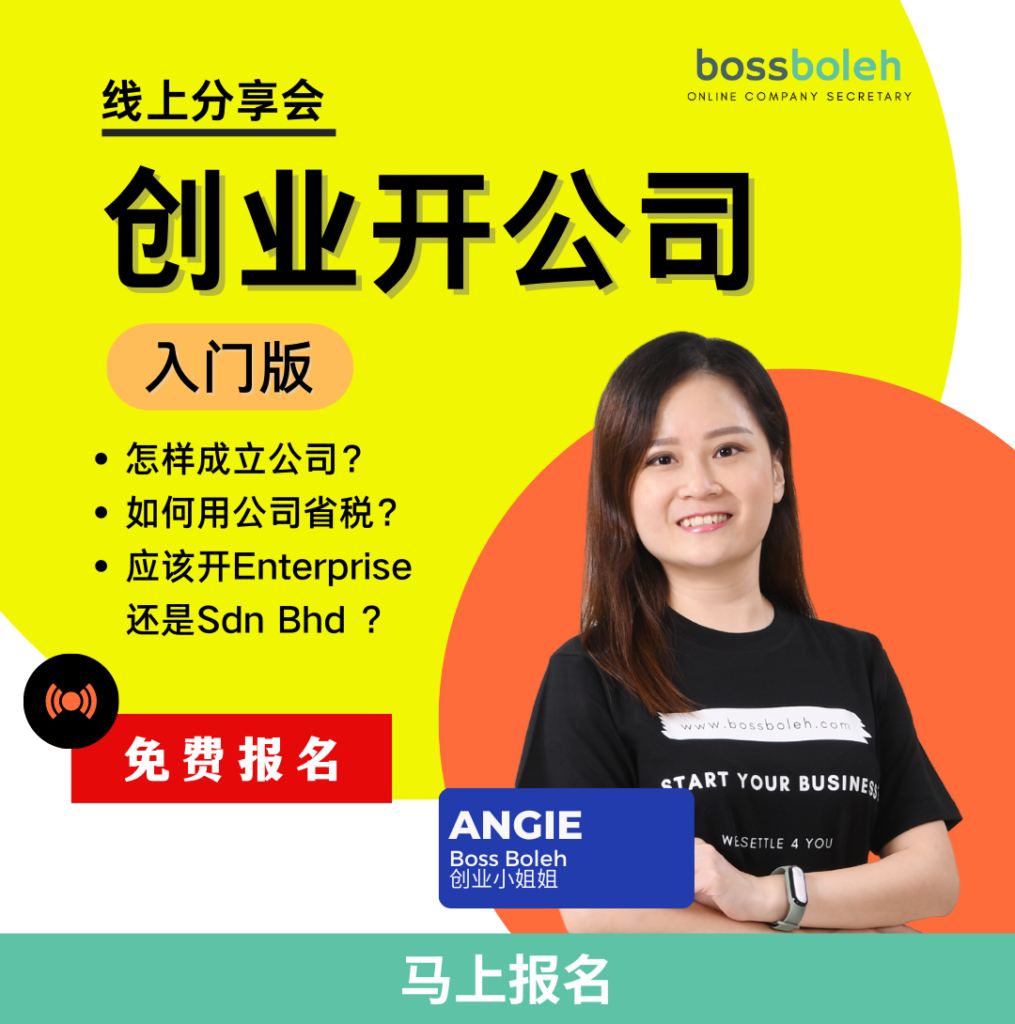

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

Are you ready to form your Sdn Bhd with Malaysia’s #1 award-winning Online Company Secretary? Contact us now via WhatsApp @018-767 8055