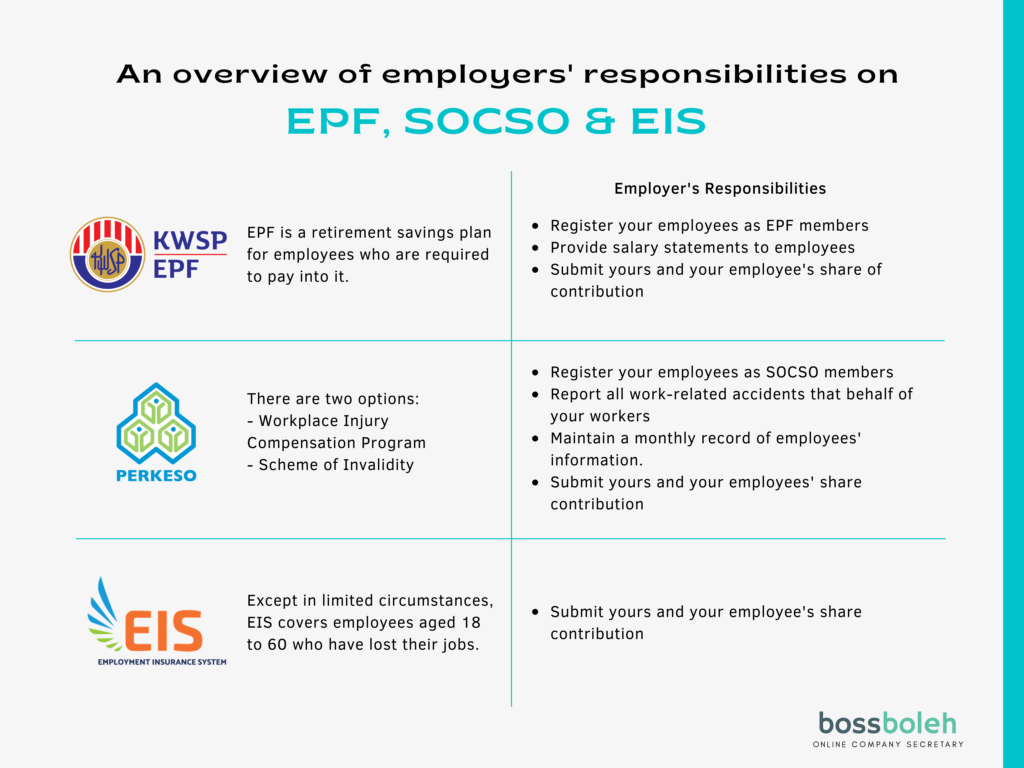

Apart from monthly salaries, Malaysian employers must contribute to their employees’ EPF, SOCSO, and EIS accounts. During your time as an employee before beginning a business, you may have observed a deduction from your monthly gross compensation as shown on your payslip. As an employer, you must pay monthly contributions to the Employee Provident Fund (or KWSP in Malay) and the Social Security Organisation (or PERKESO in Malay) for the benefit of your employees, as required by Malaysian Legislation, including EPF, SOCSO, and EIS.

1. EPF – Employees Provident Fund Contribution

The following monetary payments are subject to EPF contribution:

Salaries, reimbursement for unused yearly or sick leave, bonuses, reimbursements with some exceptions, commission, incentives, salary arrears, maternity leave, study leave and half-day leave and also other contractual and non-contractual payments,

EPF contributions are not required for the following monetary payments:

Such or gratuities and other service expenses, the payments for work done on rest days and public holidays, as well as overtime payments, the complimentary where the payment to employee payable at the end of a service period or upon voluntary resignation. Also, money in place of notice of termination which payment is made when an employee’s employment is terminated benefits upon retirement and termination, travel allowances, director’s fee. Lastly, Benefits-in-kind and nonmonetary perquisites, including cash payments for holidays such as Hari Raya and Christmas.

EPF contribution is the obligation of the employer.

• Within 7 days of employing your first employee, register as an employer with the EPF.

• Enroll your employees in the EPF and maintain their details up to date.

• Provide staff with pay statements.

• Collect your employees’ EPF contributions and submit them to the EPF alongside your employer’s contribution.

Even if they are not responsible or pay more than the required amount, your workers might opt to contribute to EPF. Furthermore, under Voluntary Contribution, you and your workers can choose to contribute more than the Statutory Contribution rate.

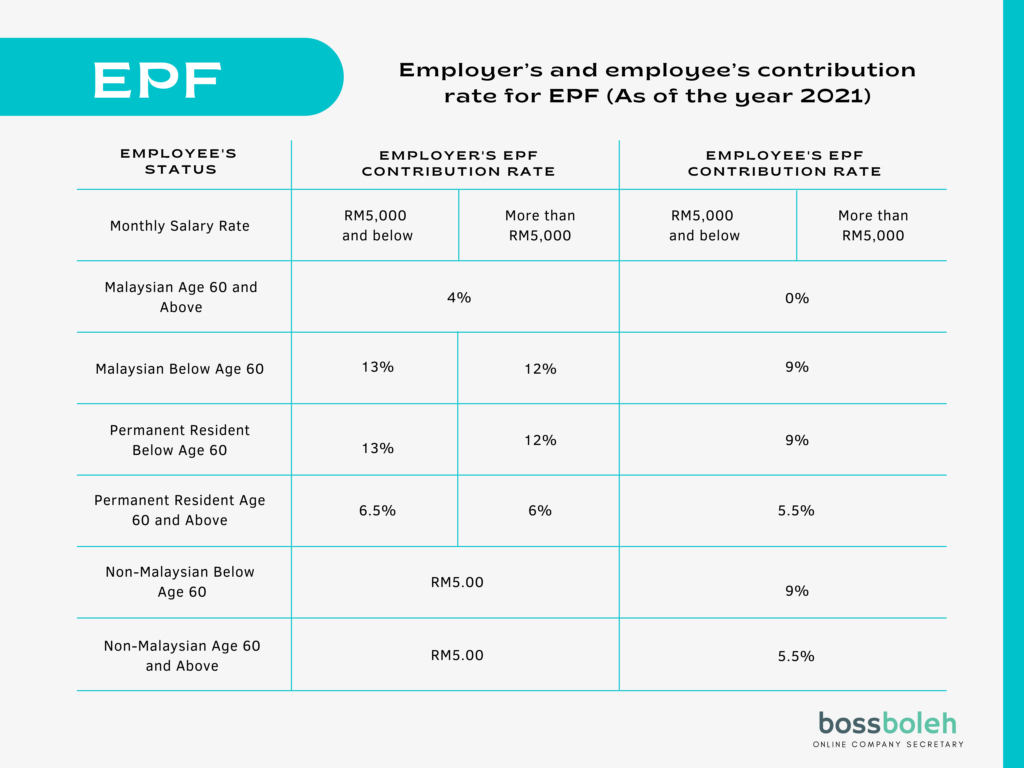

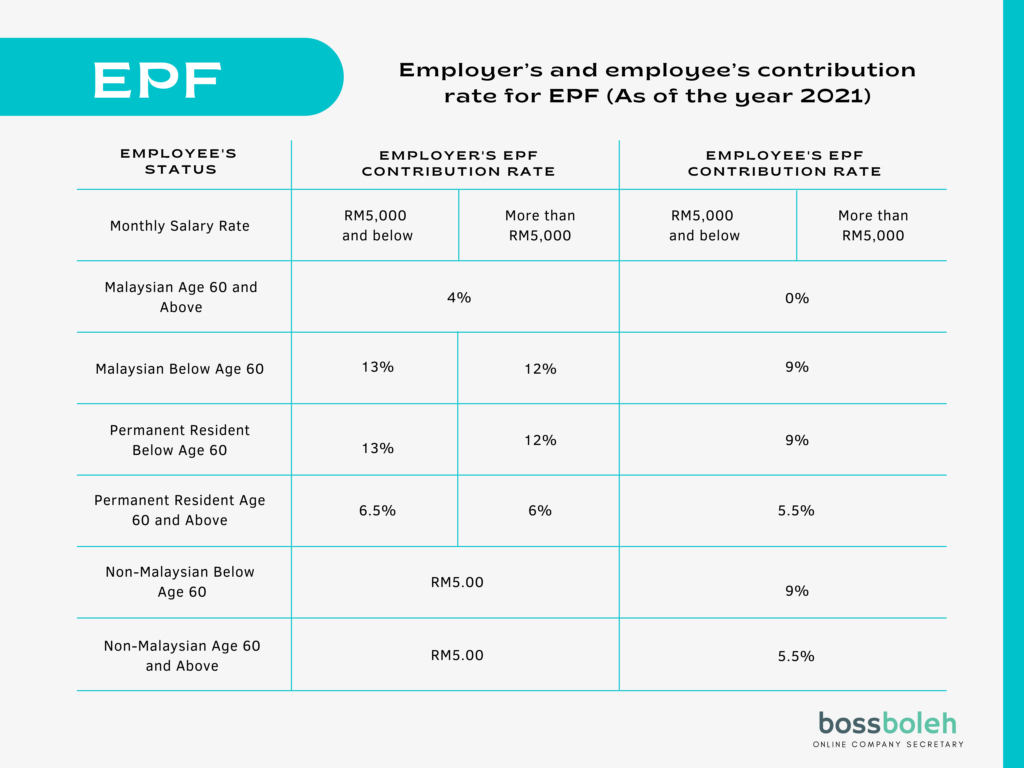

EPF contribution rates for employers and employees (as of the year 2021)

*Following the introduction of budget 2021, the EPF contribution rate for all employed under 60 years old is cut by default from 11 % to 9% from February 2021 to January 2022. If an employee wishes to continue contributing at the 11 % rate, they must complete The Borang KWSP 17A (Khas 2021), which will be sent to EPF by their company. Except for salaries above RM20,000.00, the contribution amount should be determined based on the contribution rate indicated in the Third Schedule of the EPF Act 1991, rather than using the precise percentage calculation.

When should you pay your EPF contribution?

The monthly EPF contribution, which includes both the employee’s and employer’s part, should be made by the 15th of the month for the previous month’s wage. If the EPF contribution is not made on time, a late payment fee or a dividend would be applied.

What is the procedure for making an EPF payment?

Contributions to the EPF can be made in the following ways by the e-Caruman website or mobile app, internet banking, Bank Simpanan Nasional, Maybank, Public Bank, and RHB Bank agents. Also, EPF counters around the country.

2. SOCSO – Social Security Organization Contribution

The following monetary payments are subject to SOCSO contribution:

Salaries, Overtime pay, Commissions, Wages for maternity leave, study leave, and half-day leave, Other contractual or non-contractual payments

SOCSO contribution is not required for the following monetary payments:

Any contribution that the employer is required to make to any pension or provident fund., Gratuity (payment to an employee after a service period or upon voluntary resignation, Any money provided to reimburse the employee’s expenditures spent in the course of his work, Bonuses, Travel allowances, Gifts, such as monetary payments for holidays like Hari Raya and Christmas.

The employer’s contribution to the SOCSO is their obligation.

• Within 30 days of employing your first employee, register as an employer.

• Enroll your staff in the SOCSO and maintain their information up to date.

• Within 48 hours, report any work-related accidents that occur to their employees.

• Keep a monthly record of personnel information and ensure it’s up to date.

• Collect your employees’ SOCSO contributions and send them to the SOCSO alongside your employer’s contribution.

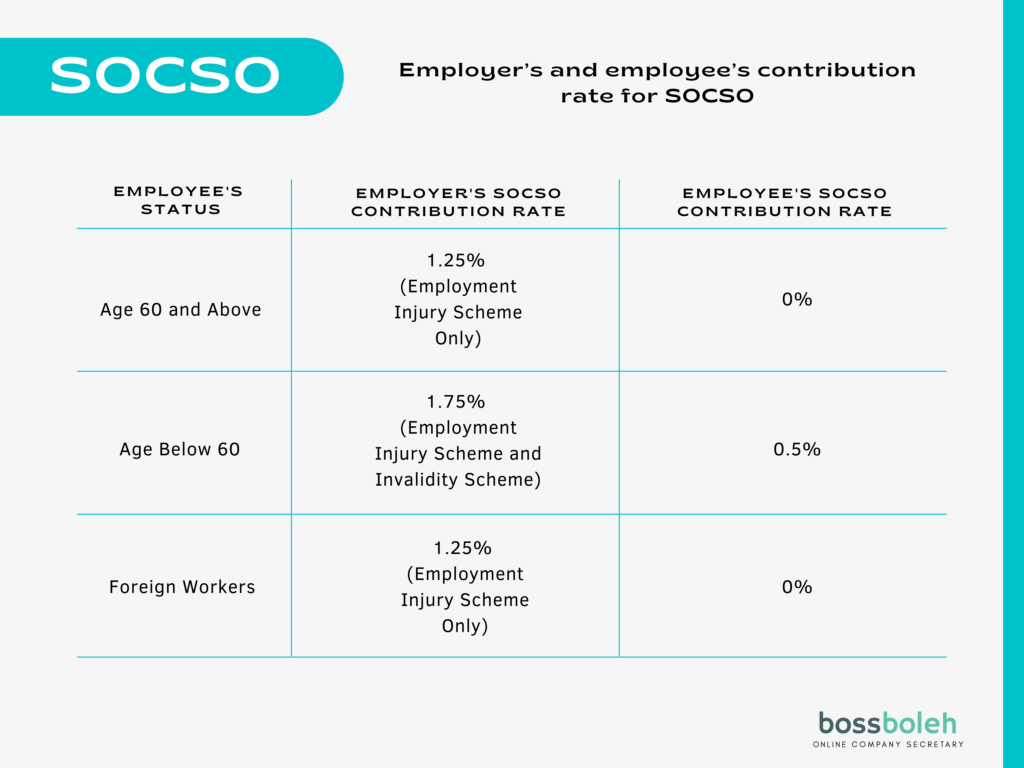

SOCSO contribution rates by employers and employees

*The contribution rates listed in this table do not apply to new workers aged 55 and over who have never contributed before. The workplace Injury Scheme solely covers them. Employees aged 60 and over are exempt from contributing to the employee’s portion of SOCSO. Please keep in mind that the contribution amount should be calculated using the contribution rate as mentioned in the Rate of Contribution table on the SOCSO website rather than utilising the precise percentage calculation. The maximum monthly contribution is set at RM4,000 per month.

When is the SOCSO contribution due?

The monthly SOCSO contribution, which includes both the employee and the employer’s portion, should be paid for the previous month’s wage by the 15th of the month. A late payment interest rate of 6% per year will be applied for each day that a contribution is not paid.

How do you can make a payment to SOCSO?

SOCSO contributions can be made using the following methods: Maybank, RHB Bank, and Public Bank agents PERKESO ASSIST portal, internet banking, cheque, money order, or postal order, bank counters, SOCSO counters all around the country.

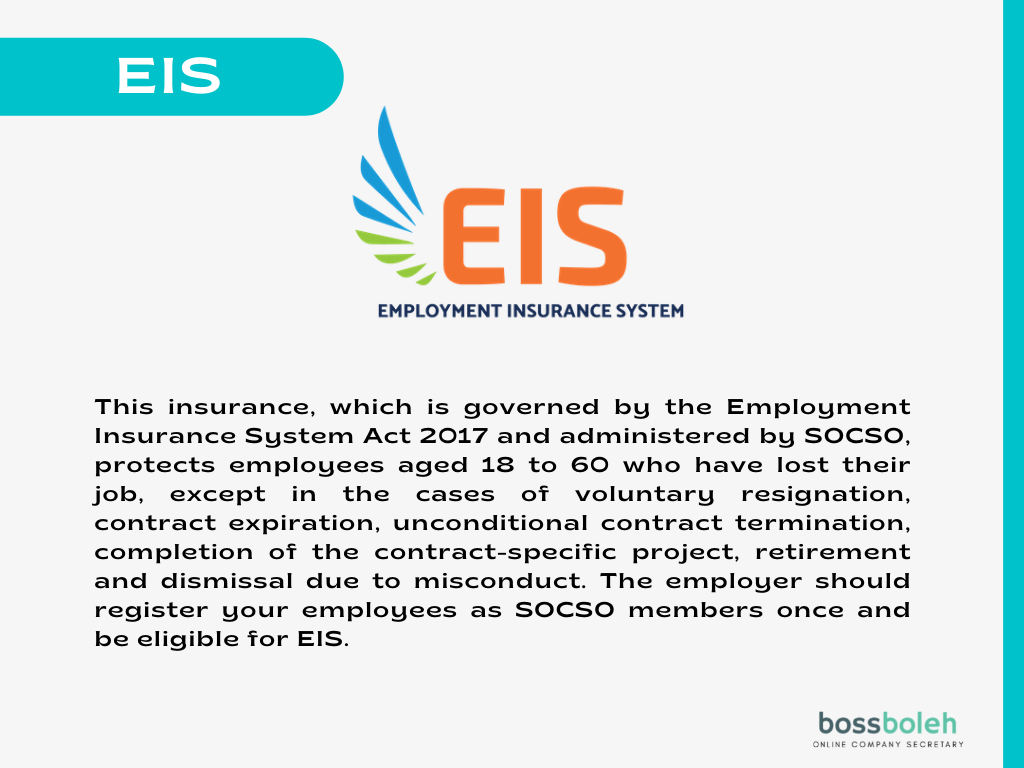

3. EIS – Employment Insurance System Contribution

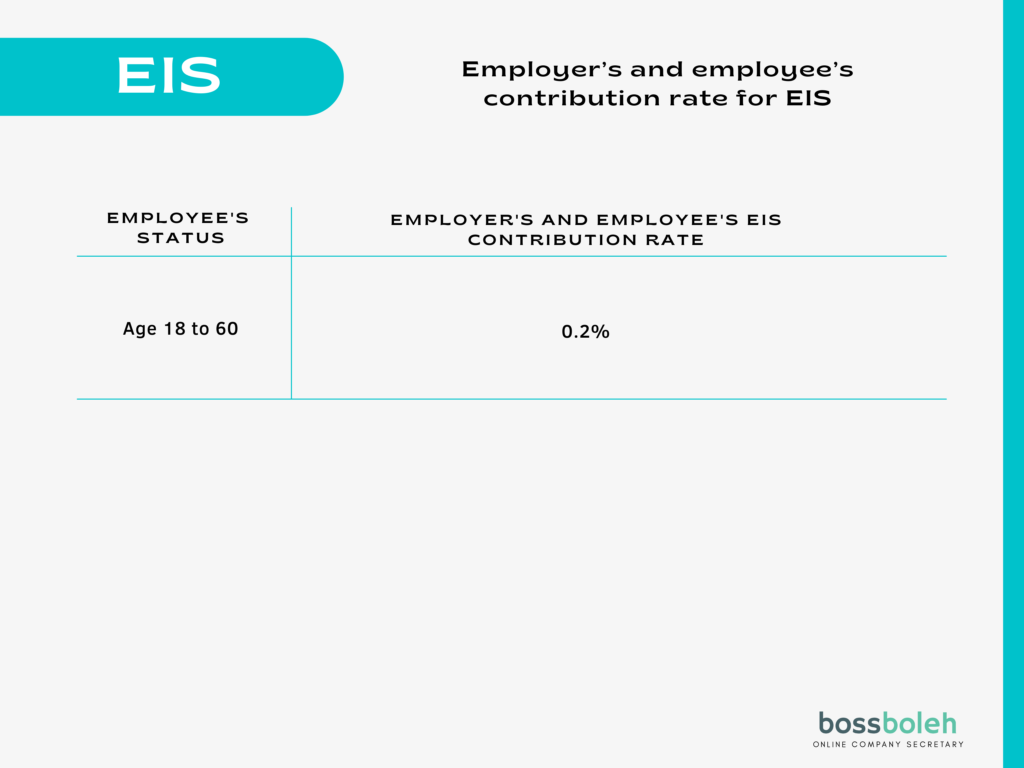

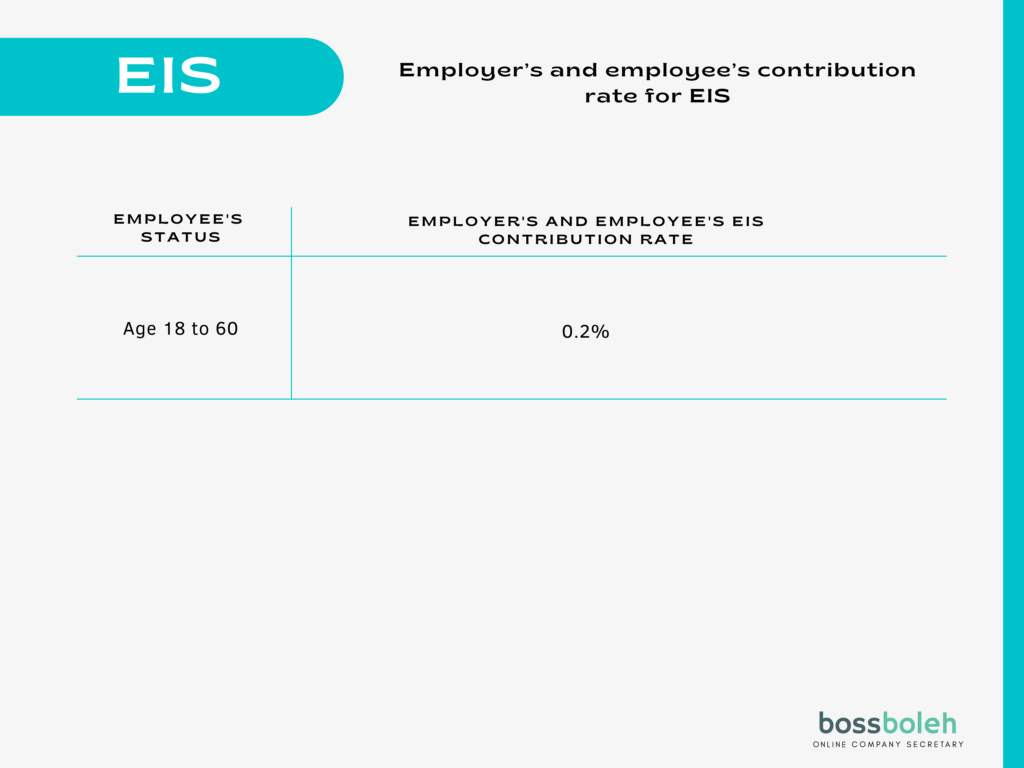

EIS contribution rates for employers and employees

*The contribution rates listed in this table do not apply to new workers aged 57 and up who have never contributed before. Please keep in mind that, rather than using the precise percentage calculation, the payment amount should be calculated using the contribution rate as indicated in the second schedule of the Employment Insurance System Act 2017. This maximum monthly contribution is set at RM4,000 per month. Please keep in mind that the contribution amount is subject to change.

When is the EIS contribution due?

Employee and employer contributions to the EIS are paid along with the SOCSO contribution.

How do you can pay for the EIS?

The EIS contribution can be made the same way that the SOCSO contribution is made.

As your company expands, managing payrolls and payments for EPF, SOCSO, and EIS for your employees can become a nuisance. It is advised that you choose a payroll service provider to handle your employees’ EPF and SOCSO registration, salary payment, payroll taxes, and EPF, SOCSO, and EIS statutory contribution.

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

Are you ready to form your Sdn Bhd with Malaysia’s #1 award-winning Online Company Secretary? Contact us now via WhatsApp @018-767 8055

1,000+ reviews with a 4.9-star rating on

1,000+ reviews with a 4.9-star rating on