HRDF is a fund for employer to train their staff.

3 Steps to claim HRDF

- Register for your employer for any HRDF claimable traning

- Employer to pay the training

- HRDF will reimburse the employer

Can I not register for HRDF ?

- If your company has 10 or more of employees, then you MUST register for HRDF.

- Charging 1% of employee monthly wages

- Refer to this list of industries.

- The following are exempted :

- Local Council

- Federal government

- State Government

- Statutory Body

- NGO with Social and Welfare Activities

Industries covered:

- Agriculture and farming

- Livestock and fisheries

- Forestry and logging

- Mining and quarrying

- Manufacturing and production

- Trading, business and wholesale

- Construction

- Supply

- Property

- Culture, arts and entertainment

- Fashion and clothes

- Cosmetic

- Tourism and recreation

- Service

- Franchise

- Electricity

- Oil

- Gas and steam

- Water Sewerage

- Management of solid waste, liquid and gaseous and remedial

- Automotive

- Transportation

- Repair and maintenance

- Storage

- Delivery

- Food and beverages

- Information system

- Communication and multimedia

- Broadcasting and films

- Banking and finance

- Insurance and takaful

- Investment

- Co-operative societies

- Professional

- Science and technology

- Research and development

- Science and technicality

- Administration and support service

- Education

- Medical and health facilities

- Social welfare

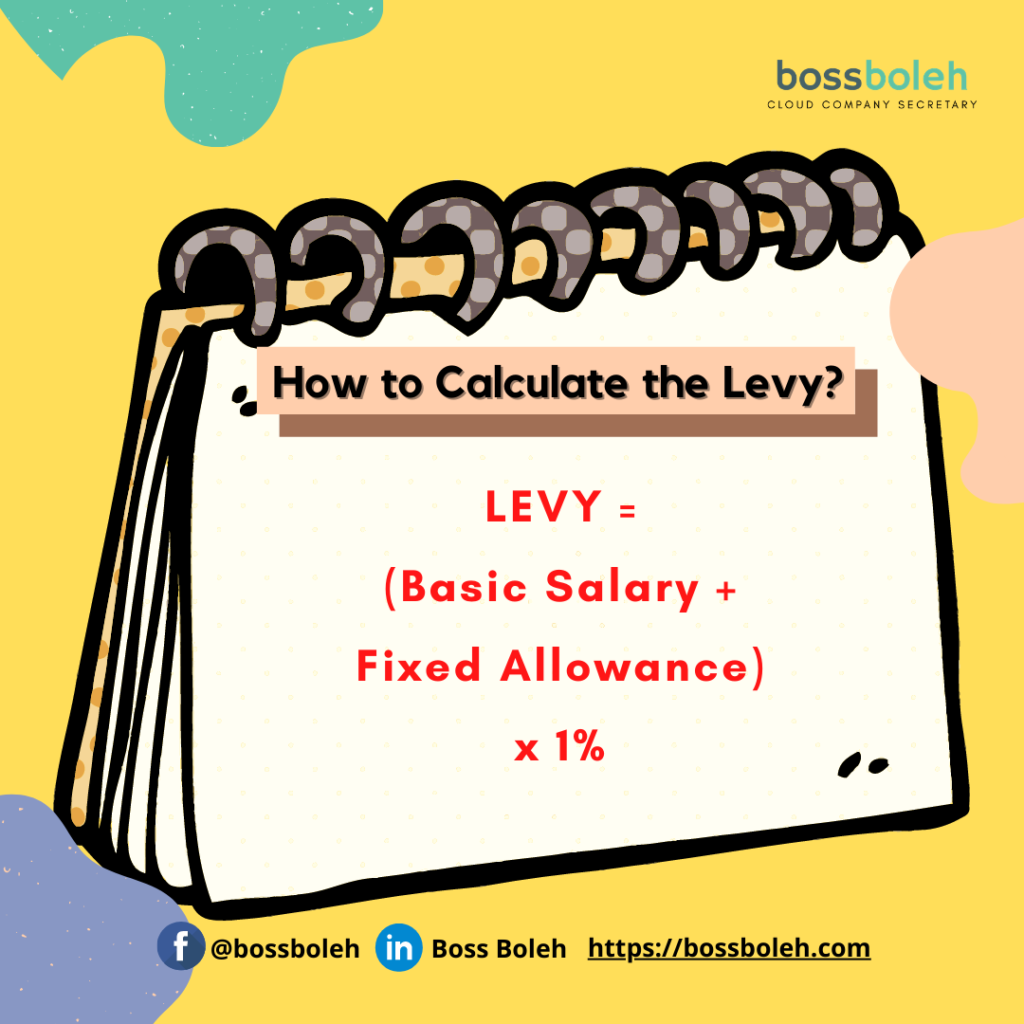

How to calculate the Levy?

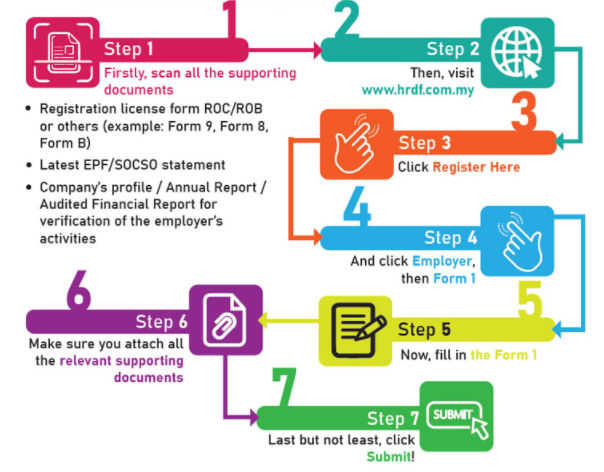

Documents required to register HRDF ?

- Certificate of Incorporation / registration

- (Form 9 / business license / Form 8 / Section 14 Super form and other registration certificate)

- Documents for no. of employees

- (EPF statement / SOCSO statement)

- Documents for employers activities

- (Company profile / annual report or other documents showing employers activities)

How to register HRDF ?

Q & A

? Who should register?

? If your company has 10 or more of employees, then you MUST register for HRDF.

? How much does the employer need to pay for each month?

? 1% of the employee’s monthly salary.

? Is the 1% being deducted directly from the employee’s salary?

? No. It’s being paid by the employer.

? How do employer make payment?

? Payment can be made via online

? Who considered as an employee?

? Sdn Bhd – director and employee

? Sole Prop & Partnership – employee only

? How to register?

? Registration can be done via HRDF website or walk-in

? Click here.

? What does salary mean?

? Salary means basic salary, fixed allowances, and leave pay.

? Why employers have to pay HRDF levy? Any benefits?

? Employers are able to claim training grants from HRDF for the cost (course fee, transportation & accommodation) incurred in sending its employee to attend a training program or providing internal training (recognized speaker).

? How to claim?

? Claim can be made via HRDF website.

? Can employers not register with HRDF? What are the consequences?

? Any employer who meets the criteria and choose not to register with HRDF shall be liable to a fine of not more than RM10,000 or to imprisonment for a term not exceeding one year or to both.

For more information, please visit the HRDF website.

Want to know more about starting a Sdn Bhd? What’s the best way to start one, and what should you be mindful of? Register and find out in our upcoming webinar!

Are you ready to form your Sdn Bhd with Malaysia’s #1 award-winning Online Company Secretary? Contact us now via WhatsApp @018-767 8055

1,000+ reviews with a 4.9-star rating on

1,000+ reviews with a 4.9-star rating on